UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

Proxy Statement Pursuant to Section 14(a) ofSECURITIES EXCHANGE ACT OF 1934

the Securities Exchange Act of 1934 (Amendment No.(AMENDMENT NO. )

Filed by the Registrant ☑☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material | |

SALISBURY BANCORP, INC.

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

NAME OF PERSON(S) FILING PROXY STATEMENT, IF OTHER THAN THE REGISTRANT)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | ||||

Aggregate number of securities to which transaction applies: | ||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) |

Proposed maximum aggregate value of transaction: | ||

| (5) |

Total fee paid: | ||||

| ☐ | ||||

| Fee paid previously with preliminary materials. | ||||

| ☐ | Check box if any part of the fee | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) |

Filing Party: | ||||

| (4) | Date Filed: |

5 BISSELL STREET

P.O. BOX 1868

LAKEVILLE, CONNECTICUT 06039-1868

(860) 435-98011.860.435.9801

NOTICE OF 20212022 ANNUAL MEETING OF SHAREHOLDERS

| Time and Date: | 4:00 p.m., Eastern Daylight Savings Time (“EDST”), Wednesday, May |

| Location: | Salisbury Bank’s Operations Center, 33 Bissell Street, Lakeville, Connecticut 06039 |

| Record Date: | Shareholders at the close of business on March |

| Matters to be | 1. Election of |

| 2. Approval of the amendment to Salisbury Bancorp, Inc.’s Certificate of Incorporation to increase authorized common stock from 5,000,000 shares to 10,000,000 shares (referred to as the “Certificate of Amendment Proposal”). | |

| 3. Ratification of the appointment of Baker Newman & Noyes, P.A., LLC as independent auditors for Salisbury Bancorp, Inc. for the fiscal year ending December 31, | |

Your vote is very important to us and we request that you vote your shares, regardless of the number of shares you own. You can voteIf you hold your shares in registered form, you have the choice of voting your shares via the internet, toll-free telephone call, or by completing, signing and returning the enclosed proxy card for which a postage-prepaid return envelope is provided. If your shares are held in the name of a broker, bank or other holder of record, you must vote in the manner directed by such holder.

Directions to Salisbury Bank’s Operations Center may be obtained by writing to Shelly L. Humeston, Secretary, Salisbury Bank and Trust Company, 5 Bissell Street, P.O. Box 1868, Lakeville, Connecticut 06039-1868, by email at shumeston@salisburybank.com or by calling 1-860-453-34321.860.453.3432 or toll-free at 1-800-222-9801.1.800.222.9801.

BY ORDER OF THE BOARD OF DIRECTORS OF

SALISBURY BANCORP, INC.

Shelly L. Humeston

Secretary

April 5, 20218, 2022

Lakeville, Connecticut

Whether or not you plan to attend the Annual Meeting, we encourage you to vote as promptly as possible via the internet, telephone, or by completing, signing and returning the enclosed proxy card. If you attend the meeting and wish to change your vote, you can do so by voting in person at the meeting. A Shareholder may also revoke a proxy at any time before it is voted at the Annual Meeting by giving notice, in writing, to Shelly L. Humeston, Secretary, 5 Bissell Street, P.O. Box 1868, Lakeville, Connecticut 06039-1868. The presence of a Shareholder at the Annual Meeting will not automatically revoke that Shareholder’s proxy.

Salisbury intends to hold the Annual Meeting in person. However, Salisbury is actively monitoring the coronavirus (COVID-19) situation, and we are sensitive to public health and concerns our Shareholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold the Annual Meeting in person or at Salisbury Bank’s Operations Center, we will announce alternative arrangements as promptly as practicable. Please monitor Salisbury’s website at salisburybank.com for updated information. If you are planning to attend the Annual Meeting, please check the website one week prior to the meeting date.Annual Meeting.

5 BISSELL STREET

P.O. BOX 1868

LAKEVILLE, CONNECTICUT 06039-1868

(860) 435-98011.860.435.9801

PROXY STATEMENT FOR 20212022 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 19, 202118, 2022

INTRODUCTION

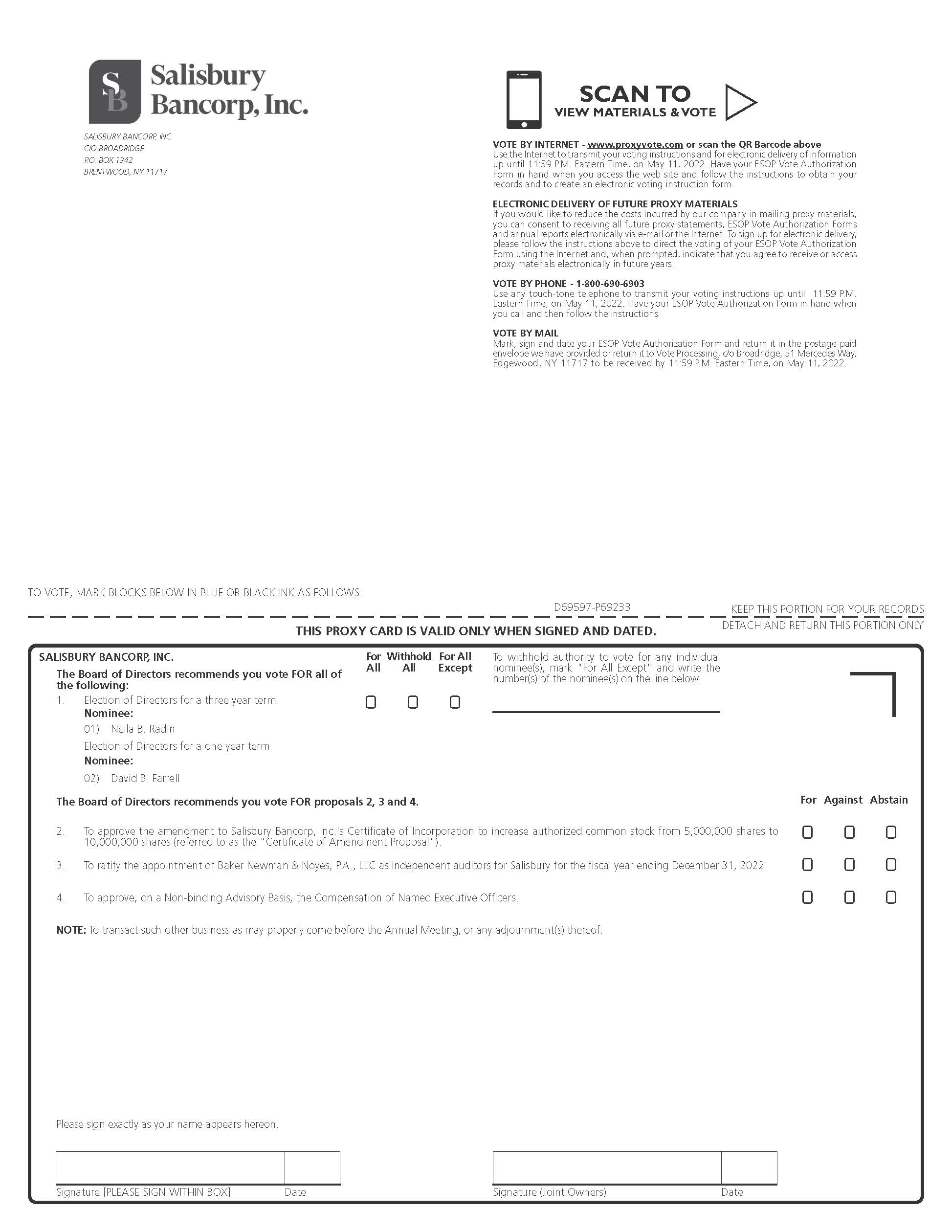

The enclosed proxy card is solicited by the Board of Directors (the “Board of Directors”) of Salisbury Bancorp, Inc. (“Salisbury”), for use at the 20212022 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Wednesday, May 19, 2021,18, 2022, at 4:00 p.m. EDST, at Salisbury Bank’s Operations Center, 33 Bissell Street, Lakeville, Connecticut 06039, and at any and all adjournment(s) thereof. Any Proxy given may be revoked at any time before it is actually voted on any matter in accordance with the procedures set forth on the Notice of Annual Meeting. This Proxy Statement and the enclosed proxy card are first being mailed to Shareholders (the “Shareholders”) of record as of the close of business on March 15, 202116, 2022 beginning on or about April 5, 2021.8, 2022. Your vote is important. Please vote your proxy promptly so your shares can be represented.

The cost of preparing, assembling and mailing this Proxy Statement and the material enclosed herewith is being borne by Salisbury. In addition, proxies may be solicited by directors, officers and employees of Salisbury and Salisbury Bank and Trust Company (the “Bank”) personally by telephone or other means. Salisbury will reimburse banks, brokers, and other custodians, nominees, and fiduciaries for their reasonable and actual costs in sending the proxy materials to the beneficial owners of Salisbury’s common stock (the “Common Stock”).

VOTING, QUORUM AND VOTES REQUIRED

The Board of Directors has fixed the close of business on March 15, 202116, 2022 as the record date (the “Record Date”) for the determination of Shareholders entitled to notice of and to vote at the Annual Meeting. As of the Record Date, 2,845,1472,876,047 shares of Salisbury’s Common Stock (par value $0.10 per share) were outstanding and entitled to vote and held by approximately 2,4392,388 Shareholders of Record. Each share of Common Stock is entitled to one vote on all matters to be presented at the Annual Meeting. Votes withheld and abstentions are not treated as having voted on any proposal and are counted only for purposes of determining whether a quorum is present at the Annual Meeting.

The Board of Directors has determined that the matters to be considered at the Annual Meeting are in the best interest of Salisbury and its shareholders, and the Board of Directors unanimously recommends a vote “FOR” the election of the director nominees, “FOR” the Certificate of Amendment Proposal, and “FOR” each other matter to be considered.

If the enclosed proxy card is properly executed and received by Salisbury in time to be voted at the Annual Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon. Executed but unmarked proxies will be voted “FOR” all the Nominees in Proposal 1,1and “FOR” Proposals 2, and 3 and 4, in accordance with the determination of a majority of the Board of Directors as to other matters discussed in this Proxy Statement. As of the date of this Proxy Statement, the Board of Directors and Management do not know of any matters other than those described in the Notice of Annual Meeting that are to come before the Annual Meeting.

If your shares are in a brokerage or fiduciary account (in “street name”), your broker or bank will send you a voting instruction form instead of a proxy card. Please follow the instructions on such form to instruct your broker, bank or other holder of record how to vote your shares.

Please note that brokers, banks and other holders of record holding your shares in street name may not vote such shares on “non-routine” matters such as the election of directors unless they have received voting instructions from the beneficial owner. When instructions are not received, a “broker non-vote” occurs. Broker non-votes are not treated as having voted on any proposal and are counted only for purposes of determining whether a quorum is present at the Annual Meeting. If you wish to attend the meetingAnnual Meeting and vote your street name shares in person, you must follow the instructions on the voting instruction form to obtain a legal proxy from your broker, bank or other holder of record. Alternatively, you may vote by telephone or via the internet as instructed by your broker or bank, if applicable.

The presence at the Annual Meeting or by properly executed proxy of the holders of a majority of Salisbury’s outstanding shares of common stock is necessary to constitute a quorum at the Annual Meeting. Directors are elected by a plurality of votes cast, without regard to either broker non-votes or proxies as to which authority to vote for the nominees being proposed is withheld. Approval of the Certificate of Amendment Proposal and the ratification of the appointment of Baker, Newman & Noyes, P.A., LLC as Salisbury’s independent auditors for the year ending December 31, 2022 are each determined by a majority of the votes cast. As to the advisory, non-binding resolution with respect to executive compensation as described in this Proxy Statement, a shareholder may: (i) vote “FOR” the resolution; (ii) vote “AGAINST” the resolution; or (iii) “ABSTAIN” from voting on the resolution. The affirmative vote of a majority of the votes cast at the Annual Meeting, without regard to either broker non-votes or shares as to which the “ABSTAIN” box has been selected on the proxy card, is required for the approval of this non-binding resolution.

If you participate in the Salisbury Bank and Trust Company Employee Stock Ownership Plan (the “ESOP”), you will receive a vote authorization form for the ESOP that reflects all shares of Salisbury allocated to your account that you may direct the trustee of the ESOP to vote on your behalf. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the shares of Salisbury Common Stock allocated to his or herthe participant’s account. The ESOP trustee, subject to the exercise of its fiduciary responsibilities, will vote all allocated shares for which it has received voting instructions in accordance with such instructions and will vote all shares for which a participant has marked the vote authorization form to “ABSTAIN” and all allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions. The deadline for returning your ESOP vote is 11:59 p.m. EDST Wednesday, May 12, 2021.

11, 2022.

VOTING METHODS

Via the Internet

If you wish to vote via the internet, go to www.proxyvote.com and follow the instructions. You will need the 16-digit control number that is included in the Notice of Internet Availability of Proxy Materials, proxy card or voting instructions form that is sent to you. The internet voting system allows you to confirm that the system has properly recorded your votes. This method of voting will be available 24 hours a day, 7 days a week, up until 11:59 p.m. EDST, on May 18, 2021.17, 2022.

By Telephone

If you wish to vote by telephone, call toll-free 1-800-690-69031.800.690.6903 and follow the instructions. You will need the 16-digit control number that is included in the Notice of Internet Availability of Proxy Materials, proxy card or voting instructions form that is sent to you. As with internet voting, you will be able to confirm that the system has properly recorded your votes. This method of voting will be available 24 hours a day, 7 days a week, up until 11:59 p.m. EDST, on May 18, 2021.17, 2022.

By Mail

You can also vote by completing, dating and signing your proxy card exactly as your name appears on the proxy card and returning it by mail in the postage-paid envelope provided to you. If you hold your shares in street name and you elect to receive your proxy materials by mail, you can vote by completing and mailing the voting instruction form that will be provided by your bank, broker or other holder of record. You should mail the proxy card or voting instruction form in plenty of time to allow delivery prior to the meeting. Do not mail the proxy card or voting instruction form if you are voting via the internet or by telephone.

At the Annual Meeting

Whether you are a Shareholder of record or your shares are held in street name, you may vote your shares at the Annual Meeting if you attend in person. If you own shares held in street name and you intend to vote at the Annual Meeting, you will need to bring to the Annual Meeting a legal proxy from your bank, broker, or other holder of record that authorizes you to vote the shares that the record holder holds for you in its name.

Even if you plan to attend the Annual Meeting, we encourage you to vote via the internet or by telephone prior to the meeting. It is fast and convenient, and your vote is recorded and confirmed immediately.

| 2 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 19, 202118, 2022

This Notice, the Proxy Statement, Salisbury’s 20202021 Annual Report, and the Proxy Card or voting instruction form are available, free of charge, at salisburybank.com.

The information found on, or otherwise accessible through, Salisbury’s website is not incorporated by reference hereto, and is not otherwise a part of, this Proxy Statement.

| 3 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Management

The following table sets forth certain information as of March 15, 202116, 2022 regarding the number of shares of Common Stock beneficially owned by each Director, Nominee for Director, and Named Executive Officer (“NEO”) of Salisbury, and by all Directors, Nominees for Director, and Executive Officers of Salisbury as a group.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class (%)(2) | Amount and Nature of Beneficial Ownership (1) | Percent of Class (%) (2) |

| Peter Albero | 6,467(3) | * | 10,090(3) | * |

| Charles M. Andola | 26,222 | * | ||

| George E. Banta | 103,339 (4) | 3.63 | 106,265 (4) | 3.69 |

| Arthur J. Bassin | 16,491 (5) | * | 16,891 (5) | * |

| Richard J. Cantele, Jr. | 27,724 (6) | * | 34,174 (6) | 1.18 |

| John M. Davies | 13,849(7) | * | 16,553(7) | * |

| David B. Farrell | 7,058 | * | 7,505 | * |

| Paul S. Hoffner | 14,076 | * | ||

| Nancy F. Humphreys | 7,892 (8) | * | 8,292 (8) | * |

| Holly J. Nelson | 5,023 (9) | * | 5,520 (9) | * |

| John F. Perotti | 16,192 (10) | * | ||

| Neila B. Radin | 720 | * | 1,120(10) | * |

| Grace E. Schalkwyk | 1,502 | * | 1,928 | * |

| All Directors, Nominees for Director, and Executive Officers of Salisbury as a group of seventeen (17) persons | 252,761 | 8.88 | 252,941 | 8.79 |

* Percent ownership is less than 1%.

| (1) | The shareholdings include, in certain cases, shares owned by or in trust for a director’s spouse and/or children or grandchildren, and in which all beneficial interest has been disclaimed by the director. The shareholdings also include shares that the director has the right to acquire within sixty (60) days of March |

| (2) | Percentages are based upon the |

| (3) | Mr. Albero is a NEO of Salisbury. Includes |

| (4) | Includes |

| (5) | Includes 13,791 shares owned by the Arthur J. Bassin and Susan B. Bassin Revocable Agreement of Trust. |

| (6) | Mr. Cantele is a NEO of Salisbury. Includes |

| (7) | Mr. Davies is a NEO of Salisbury. Includes |

| (8) | Includes 4,102 shares owned jointly by Nancy F. Humphreys and her spouse. Mrs. Humphreys is retiring from the Board effective at the Annual Meeting on May 18, 2022. |

| (9) | Includes 9 shares owned by Holly J. Nelson as guardian for a minor child. |

| (10) | Includes |

| 4 |

Security Ownership of Certain Beneficial Owners (Principal Shareholders)

Persons and groups who beneficially own more than five percent (5%) of Salisbury’s common stock are required to file certain reports with the Securities and Exchange Commission (“SEC”). Management is not aware of any person (including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) who beneficially owns more than 5% of Salisbury’s Common Stock (a “Principal Shareholder”) as of the Record Date (March 15, 2021)16, 2022) except as set forth in the table below:

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Shares Outstanding(1) |

| BlackRock, Inc.(2) | 150,509 | 5.3% |

| Name and Address of Beneficial Owner(2) | Amount and Nature of Beneficial Ownership | Percentage of Common Shares Outstanding(1) |

FJ Capital Management LLC 7901 Jones Branch Dr., Ste. 210 McLean, VA 22102 | 182,949 | 6.36% |

(2) Based on information as of December 31, 2021, obtained from a Schedule 13G filed with the SEC on or about February 8, 2022, by FJ Capital Management LLC. FJ Capital Management LLC reported in its Schedule 13G that it has shared voting power and shared dispositive power over 182,949 shares (6.36%) which consist of 174,096 shares (6.05%) held by Financial Opportunity Fund LLC of which FJ Capital Management LLC is the managing member and has shared voting power and shared dispositive power, and 8,853 shares held by a separate managed account of which FJ Capital Management LLC is the managing member; as such, the Reporting Person may be deemed to be a beneficial owner of reported shares but as to which the Reporting Person disclaims beneficial ownership. Martin Friedman is the Managing Member of FJ Capital Management LLC; as such, Mr. Friedman may be deemed to be a beneficial owner of reported shares but as to which Mr. Friedman disclaims beneficial ownership. The foregoing information has been included solely in reliance upon, and without independent investigation of, the disclosures contained in FJ Capital Management LLC’s Schedule 13G. |

Executive Officers

The following table sets forth information regarding the executive officers of Salisbury, and the executive officers of the Bank thatwho are deemed executive officers of Salisbury pursuant to Rule 3b-7 of the Exchange Act, followed by certain biographical information as of December 31, 2020.2021. Executive Officers are generally appointed by the Board each year following the Annual Meeting.

Name | Position | Age | Years of Service | Position | Age | Years of Service | ||||||

| Peter Albero(1) | Executive Vice President and Chief Financial Officer of Salisbury and the Bank | 56 | 3 | Executive Vice President and Chief Financial Officer of Salisbury and the Bank | 57 | 4 | ||||||

| Carla L. Balesano(2) | Executive Vice President and Chief Credit Officer of the Bank | 66 | <1 | Executive Vice President and Chief Credit Officer of the Bank | 67 | 1 | ||||||

| Richard J. Cantele, Jr.(3) | President and Chief Executive Officer of Salisbury and the Bank | 61 | 39 | President and Chief Executive Officer of Salisbury and the Bank | 62 | 40 | ||||||

| Todd M. Clinton(4) | Executive Vice President and Chief Risk Officer of the Bank | 59 | 34 | Executive Vice President and Chief Risk Officer of the Bank | 60 | 35 | ||||||

| John M. Davies(5) | President of NY Region and Chief Lending Officer of the Bank | 58 | 6 | President of NY Region and Chief Lending Officer of the Bank | 59 | 7 | ||||||

| Steven M. Essex(6) | Executive Vice President and Head of Trust Wealth Advisory Division of the Bank | 51 | 11 | Executive Vice President and Head of Salisbury Bank Wealth Advisory | 52 | 12 | ||||||

| Amy D. Raymond(7) | Executive Vice President and Chief Retail Banking Officer of the Bank | 49 | 19 | Executive Vice President and Chief Retail Banking Officer of the Bank | 50 | 20 | ||||||

| Elizabeth A. Summerville(8) | Executive Vice President and Chief Retail and Loan Operations Officer of the Bank | 61 | 17 | Executive Vice President and Chief Retail and Loan Operations Officer of the Bank | 62 | 18 | ||||||

| (1) | Mr. Albero was appointed Executive Vice President and Chief Financial Officer of Salisbury and the Bank on October 20, 2017. Mr. Albero holds a BS in Accounting and Finance from Manhattan College and an MBA from New York University. He is a Certified Public Accountant with more than 20 years of accounting management. He previously served as Director, Financial Services Advisory Practice at PricewaterhouseCoopers LLP, New York, NY since September 2015. Prior to that, Mr. Albero spent 27 years at Morgan Stanley, New York, NY most recently serving as Managing Director, Head of SEC Reporting and Disclosure from June 2014 to July 2015. He served as Managing Director, Head of Regulatory Reporting from September 2012 to May 2014 and prior to that, as Managing Director, Head of Corporate Reporting and Analysis from December 2007 to August 2012. |

| (2) | Ms. Balesano was appointed Executive Vice President and Chief Credit Officer of the Bank on July 27, 2020. Ms. Balesano previously served as SVP, Syndicated Lending at Liberty Bank. Prior to that, she was an Executive Credit Officer and Head of Corporate Loan Strategies at Peoples United Bank, and Managing Senior Credit Officer at TD Bank, where she was responsible for the leadership and management of a team of credit officers overseeing and managing commercial and corporate banking credit activities. She has also held senior credit positions at Webster Bank and Bank of America. Carla received her AD from Manchester Community College, has completed numerous professional development courses with RMA, and has continued her education at the University of Connecticut. |

| (3) | Mr. Cantele has been a director of Salisbury and the Bank since 2005. Mr. Cantele graduated from Fairfield University in 1981 with a Bachelor of Science degree in Finance; and graduated from the Stonier Graduate School of Banking in 1997. Mr. Cantele became President and Chief Executive Officer of Salisbury and the Bank in 2009, prior to which he served as President and Chief Operating Officer of Salisbury and the Bank since 2005. Mr. Cantele has been an executive officer of Salisbury since 2001 and of the Bank since 1989, serving as Executive Vice President, Treasurer and Chief Operating Officer of the Bank and Salisbury and Secretary of Salisbury. |

| 5 |

| (4) | Mr. Clinton joined the Bank in 1987. He was named Executive Vice President and Chief Risk Officer in May of 2014. Prior to that, he served as Senior Vice President, Chief Technology and Compliance Officer of the Bank since June of 2002. Mr. Clinton served as Operations Officer of the Bank from September of 1997 to June of 2002. He is a graduate of the Connecticut School of Finance and Management and the ABA Compliance Management School and has more than 35 years of experience in community banking. |

| (5) | Mr. Davies joined the Bank as President of the New York Region in December of 2014 and subsequently assumed the additional responsibility of Chief Lending Officer. Prior to that, Mr. Davies served as President and Chief Executive Officer of Riverside Bank for three years and served as Executive Vice President of Riverside Bank prior to that. He is a graduate of Pace University with |

| (6) | Mr. Essex joined the Bank in 2009 as Vice President, Trust Officer. In January of 2014 he assumed responsibility as Interim Head of the Trust Wealth Advisory Department. In June of 2014, he was promoted to Senior Vice President, Head of Trust Wealth Advisory Services, and in May 2016 he was promoted to Executive Vice President, Head of Trust Wealth Advisory Services. Mr. Essex is a graduate of the University of Connecticut with a Bachelor’s degree in Economics. He has more than 20 years of experience in high net worth relationship management, business development, and financial and estate planning. |

| (7) | Mrs. Raymond joined the Bank in June of 2001 as Special Projects Coordinator. She has held a number of different positions within the Bank since that time, including Branch Manager, Mortgage Processor, and Sales Manager for Mortgage Originations. In May of 2006 she was promoted to Assistant Vice President, Mortgage Origination. In May of 2007 she was promoted to Vice President, Mortgage Origination. In May of 2014 she was promoted to Senior Vice President, Retail Lending and CRA Officer. In April of 2015 she was named Senior Vice President, Retail and Commercial Operations Manager, CRA Officer. Mrs. Raymond was named Executive Vice President and Chief Retail Banking Officer in February of 2019. She holds a BS in Business Management from the University of New Haven. She has more than |

| (8) | Mrs. Summerville joined the Bank in |

PROPOSAL 1

ELECTION OF DIRECTORS

The Board regularly evaluates its size and structure to ensure it is appropriate to best serve Salisbury and the best interests of its Shareholders. Salisbury’s Bylaws provide that the number of directors shall be fixed from time to time by the Board of Directors. The Board of Directors has set the number of directors following the Annual Meeting at nine (9)eight (8). The Board of Directors of Salisbury is divided into three (3) classes as nearly equal in number as possible. Classes of directors serve for staggered three (3) year terms. A successor class is elected at each Annual Meeting of Shareholders when the terms of the members of that class expire. Vacant directorships may be filled, until the next meeting at which directors are elected, by the vote of a majority of the directors then in office.

On February 24, 2021, Directors Charles M. Andola and John23, 2022, Director Nancy F. Perotti eachHumphreys notified the Boards of Directors of Salisbury and the Bank of theirher intent to retire and not stand for re-election as a director, effective as of May 19, 2021,18, 2022, the date of Salisbury’s 20212022 Annual Meeting of Shareholders. Mr. Andola’s and Mr. Perotti’s retirements areMrs. Humphreys’ retirement is not the result of any disagreement with Salisbury on any matter relating to Salisbury’s operations, policies or practices.

Shareholders are being asked to elect the three (3)two (2) nominees listed below to the Board of Directors of Salisbury for the terms set forth below. A plurality of votes cast in favor is necessary for the election of directors by Shareholders. If you sign, date and return your proxy card but do not vote for a nominee, your shares will be voted “FOR” that nominee. If you indicate “withhold” for any nominee on your proxy card, your vote will count neither “FOR” nor “AGAINST” the nominee. Unless otherwise directed, the proxies will be voted “FOR” such nominees.

Directors and Nominees for Election for a Three Year Term

The following individuals haveindividual has been nominated to serve for a three (3) year term: Arthur J. Bassin, Paul S. Hoffner, and Holly J. Nelson. Two of the three nominees (Bassin and Nelson) areNeila B. Radin. Ms. Radin is presently membersa member of the Board of Directors.

Directors and Nominees for Election for a One Year Term

The following individual has been nominated to serve for a one (1) year term: David B. Farrell. Mr. Farrell is presently a member of the Board of Directors.

| 6 |

The following table sets forth certain information, as of March 15, 2021,16, 2022, with respect to Salisbury’s directors.

Nominees for election for terms expiring in 2024 | ||||||||

Nominees for election for terms expiring in 2025 | Nominees for election for terms expiring in 2025 | |||||||

Name | Age | Position | Director Since | Age | Position | Director Since | ||

| Arthur J. Bassin | 76 | Director | 2010 | |||||

| Paul S. Hoffner | 56 | Director | N/A | |||||

| Holly J. Nelson | 67 | Director | 1998 | |||||

| Neila B. Radin | 68 | Director | 2019 | |||||

Continuing directors whose terms expire in 2022 | ||||||||

Nominees for election for terms expiring in 2023 | Nominees for election for terms expiring in 2023 | |||||||

Name | Age | Position | Director Since | Age | Position | Director Since | ||

| David B. Farrell | 65 | Director | 2012 | 66 | Director | 2012 | ||

| Nancy F. Humphreys | 79 | Director | 2001 | |||||

| Neila B. Radin | 67 | Director | 2019 | |||||

Continuing directors whose terms expire in 2023 | Continuing directors whose terms expire in 2023 | Continuing directors whose terms expire in 2023 | ||||||

Name | Name | Age | Position | Director Since | Age | Position | Director Since | |

| George E. Banta | George E. Banta | 85 | Director | 2014 | 86 | Director | 2014 | |

| Richard J. Cantele, Jr. | Richard J. Cantele, Jr. | 61 | President, Chief Executive Officer, Director | 2005 | 62 | President, Chief Executive Officer, Director | 2005 | |

| Grace E. Schalkwyk | Grace E. Schalkwyk | 65 | Director | 2019 | 66 | Director | 2019 | |

Continuing directors whose terms expire in 2024 | Continuing directors whose terms expire in 2024 | |||||||

Name | Name | Age | Position | Director Since | ||||

| Arthur J. Bassin | Arthur J. Bassin | 77 | Director | 2010 | ||||

| Paul S. Hoffner | Paul S. Hoffner | 57 | Director | 2021 | ||||

| Holly J. Nelson | Holly J. Nelson | 68 | Director | 1998 | ||||

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL TO ELECT EACH OF THE THREE (3) NOMINEESONE (1) NOMINEE TO THE BOARD OF DIRECTORS FOR A TERM OF THREE (3) YEARS.YEARS AND TO ELECT ONE (1) NOMINEE FOR A TERM OF ONE (1) YEAR. DIRECTORS ARE ELECTED BY A PLURALITY OF THE VOTES CAST BY THE SHARES ENTITLED TO VOTE AT THE ANNUAL MEETING. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS SHAREHOLDERS SPECIFY A CONTRARY CHOICE ON THE PROXY.

Information about Salisbury’s Directors

The Board of Directors is composed of a diverse group of persons with a variety of experience, qualifications, attributes and skills that enable the Board of Directors to meet the needs of Salisbury’s governance principles and make a positive impact on the Bank’s business and the communities served by the Bank. In particular, the Board of Directors consists of a group of individuals who collectively bring a mix of skills and knowledge in the areas of banking, finance, accounting and business. All members of the Board of Directors have an understanding of finance and accounting, and are able to read and understand fundamental financial statements and generally accepted accounting principles and their application to the accounting of Salisbury. Each of the director’s previous experience, analytical aptitude and leadership provide Salisbury with a wealth of knowledge from which it may draw. In addition, members of the Board of Directors are active in, and knowledgeable about, the credit and banking needs of its customers and the local communities in which Salisbury and the Bank operate. These areSalisbury believes these individuals possess valuable skills and attributes for service as a director of Salisbury and the Bank. Only oneBank and that their local knowledge and experience assists Salisbury in serving its customers, the community, and shareholders.

One of Salisbury’s directors serveserves on the boards of directors of other public companies. Ms. Schalkwyk is a Director of Exchange Income Corporation, which is headquartered in Winnipeg, Canada and is a diversified acquisition-oriented corporation focused on opportunities in aerospace and aviation services and equipment, and manufacturing. At this time, the Board knows of no reason why the nominees would be unable to serve if elected.

The corporationbiographies of each of the nominees and continuing board members below contain information regarding the person’s business experience and the experiences, qualifications, attributes or skills that caused the Nominating and Governance Committee and the Board of Directors to determine that the person should serve as a director. Each existing director is headquartered in Winnipeg, Canada.also a director of the Bank.

| 7 |

Board Nominees for Terms Ending in 20242025

Arthur J. BassinNeila B. Radin has been a director of the Bank and Salisbury since June, 2010. Mr. Bassin served as an Artillery Officer in the U.S. Army from 1965 to 1967. He spent 25 years in consumer, commercial and mortgage banking at Citibank (1969-1983) and Dime Savings BankNovember, 2019. Ms. Radin is a graduate of New York (1983-1992), followed by 10University, B.A. (magna cum laude) and the Harvard Law School, J.D. She previously served as Chair of the Securities Law Committee and President of the New York Chapter of the Society of Corporate Secretaries & Governance Professionals. Ms. Radin is a recently retired Managing Director and Associate General Counsel of JPMorgan Chase & Co. (JPMC). Prior to her retirement, she served as advisor to the general counsel of JPMC on special projects. Prior to that, for more than twenty years, inshe was JPMC’s General Counsel of Corporate Law with legal responsibility for corporate law, corporate finance, mergers and acquisitions, private equity, most recently as Presidentstrategic investments, corporate securities issuances and Chief Executive Officer of TVData Technologies (1994-2001)funding, investor relations, and disclosure issues affecting the company. Ms. Radin has been previously associated with Simpson Thacher & Bartlett and Reboul, MacMurray, Hewitt, Maynard & Kristol (now combined with Ropes & Gray LLP). Mr. Bassin earned his MBA from Harvard Business School in 1969Ms. Radin’s education, experience, and his AB from Harvard College in 1965. He took office as Ancram Town Supervisor in January 2010. Mr. Bassin has served as a director on several boards and currently serves on the Boards of Cricket Hill Farm, Inc. and Cricket Hill Academy, Inc. He previously served on the Board of Amputee Coalition of America. Mr. Bassin also serves on the Ancram Town Board and the Columbia County Board of Supervisors. Mr. Bassin’s experience in board and community service, consumer, commercial and mortgage banking as well as in private equity, in addition to his demonstrated leadership skills,legal background provides valuable insight into financial services and skills to Salisbury and the Bank.

Paul S. Hoffner has been a member of the Riverside Division Advisory Board since 2015. Prior to that, he served as a Director of Riverside Bank from 2012 to 2014. Mr. Hoffner graduated from Tufts University with a Bachelor of Science in 1986 and earned his MBA from NYU’s Stern School of Business in 1988. He is President of John Herbert Company, a second-generation floor covering contractor based in Newburgh, NY. Mr. Hoffner joined such company in 1988, and 8 years later, he purchased it and began heading its business development effort, a role he is still in today. Mr. Hoffner serves on several philanthropic boards, and his primary interests are providing scholarships for local, less advantaged youth, tackling housing insecurity, poverty alleviation, and financial literacy. Mr. Hoffner has developed an extensive network of relationships in various communities that Salisbury serves which, combined with his education, leadership, and extensive business experience will serve to strengthen our Boards.

Holly J. Nelson has been a director of the Bank since 1995 and of Salisbury since 1998. Ms. Nelson graduated from Cornell University with a B.A. in 1979. She is a member of Iceland Adventure, LLC, a tour operator, and is Development and Events Coordinator for the Hotchkiss Library of Sharon, and Volunteer Coordinator for the Harlem Valley Rail Trail Association. Ms. Nelson has served in a board and leadership capacity for many organizations, including board member of the Berkshire Taconic Community Foundation and board member of the HousingUs affordable housing initiative. She has been involved in a variety of non-profit organizations in NY, CT, and MA, as well as public government positions in the Town of North East, New York. Ms. Nelson’s education, knowledge of marketing and non-profit organizations, and experience in successfully operating small businesses in the New York market area served by the Bank provides valuable perspective and leadership skills to the Board.corporate governance matters.

Continuing Directors withBoard Nominees for Terms Ending in 20222023

David B. Farrell has been a director of the Bank and Salisbury since June, 2012. Mr. Farrell was elected Chairman of the Board in May of 2019. Mr. Farrell graduated from St. Bonaventure University, cum laude, in 1977 with a B.S. degree in Business and Accounting. He was formerly employed by Coopers and Lybrand and was a Certified Public Accountant in New York State. Mr. Farrell is the Chief Executive Officer of Welle Training, Inc., an organization providing behavioral safety management to the Healthcarehealthcare industry. Mr. Farrell is also Chief Executive Officer and Founder of Farrell & Company, LLC, a management consulting firm. Mr. Farrell previously served as President and Chief Executive Officer and member of the board of directors of Bob’s Stores (1999-2008), a Division of The TJX Companies, Inc. He previously served as an officer and director of Berkshire Hills Bancorp (2005-2009). Mr. Farrell’s education and experience in the retail and financial services industries as well as his prior experience as a director of another financial institution provides valuable knowledge and insight to Salisbury and the Bank. In particular, his extensive background in accounting and financial oversight provides a unique set of skills to the Board. Mr. Farrell qualifies as a “financial expert” as defined by federal securities laws.

Nancy F. Humphreys has been a director of the Bank and Salisbury since 2001. Mrs. Humphreys graduated from Chatham College in 1963 and from Syracuse University, Maxwell Graduate School in 1965. Mrs. Humphreys retired from Citigroup New York, Citibank, in February of 2000 as Managing Director and Treasurer of Global Corporate Investment Bank North America. Mrs. Humphreys’ finance and treasury knowledge and experience are great assets, particularly in the area of asset and liability management as well as with respect to the financial services industry generally.

Neila B. Radin has been a director of the Bank and Salisbury since November 22, 2019. Ms. Radin is a graduate of New York University, B.A. (magna cum laude) and the Harvard Law School, J.D. She previously served as Chair of the Securities Law Committee and President of the New York Chapter of the Society of Corporate Secretaries & Governance Professionals. Ms. Radin is a recently retired Managing Director and Associate General Counsel of JPMorgan Chase & Co. (JPMC). Prior to her retirement, she served as advisor to the general counsel of JPMC on special projects. Prior to that, for more than twenty years, she was JPMC’s General Counsel of Corporate Law with legal responsibility for corporate law, corporate finance, mergers and acquisitions, private equity, strategic investments, corporate securities issuances and funding, investor relations, and disclosure issues affecting such company. Ms. Radin has been previously associated with Simpson Thacher & Bartlett and Reboul, MacMurray, Hewitt, Maynard & Kristol (now combined with Ropes & Gray LLP). Ms. Radin’s education, experience, and legal background provides valuable insight into financial services and corporate governance matters.

Continuing Directors with Terms Ending in 2023

George E. Banta has been a director of the Bank and Salisbury since 2014. Mr. Banta is a graduate of Cornell University, School of Hotel Administration and has over 50 years of experience in the restaurant, hotel, and real estate businesses. Mr. Banta owns the Beekman Arms Inn in Rhinebeck, New York, and serves as President of Banta Properties, Inc., which owns and operates 5 restaurants. Mr. Banta is also President of Banta Motel Co. Inc., which owns and operates 20 franchise hotels in New York, Connecticut, Pennsylvania, and New Jersey. He is also a partner in several real estate holdings. Mr. Banta’s expansive knowledge of real estate and related business experience are valuable to the Board’s overall capabilities.

Richard J. Cantele, Jr., the President and Chief Executive Officer of Salisbury and the Bank, has been a director of Salisbury and the Bank since 2005. Mr. Cantele graduated from Fairfield University in 1981 with a Bachelor of Science degree in Finance, and graduated from the Stonier Graduate School of Banking in 1997. Mr. Cantele became President and Chief Executive Officer of Salisbury and the Bank in 2009, prior to which he served as President and Chief Operating Officer of Salisbury and the Bank since 2005. Mr. Cantele has been an executive officer of Salisbury since 2001 and the Bank since 1989, serving as Executive Vice President, Treasurer and Chief Operating Officer of the Bank and Salisbury and Secretary of Salisbury. He became a director of Sharon Hospital in 2017 and President of the Sharon Hospital Board in January of 2020. Mr. Cantele’s positions as President and Chief Executive Officer along with his extensive years of service to Salisbury and the Bank provide him with thorough knowledge of the Bank and the markets which it serves.

Grace E. Schalkwyk has been a director of the Bank and Salisbury since November, 22, 2019. Ms. Schalkwyk holds a Bachelor of Commerce (Finance) with Honors from University of British Columbia, with executive education in general management from Columbia Business School and INSEAD. She holds the Board Leadership Fellow designation from the National Association of Corporate Directors (NACD). Ms. Schalkwyk is an advisor to fintech and other technology companies. Her prior experience includes positions with Standard & Poor’s, (now S&P Global) leading a global information business; Artnet AG as Chief Financial Officer with oversight of all financial functions including public disclosure;Officer; Reuters (now Refinitiv) in corporate development to address the challenges in financial information and technology, particularly with disruptive internet-based newcomers;development; and Credit Suisse First Boston (now Credit Suisse) as anin investment bankerbanking, advising clients on financings, strategic transactions, enhancing valuation, and investor engagement. Ms. Schalkwyk is active with NACD, Women Corporate Directors, cybersecurity events and fintech forums. She serves on the boardboards of Winnipeg, MB based Exchange Income Corp. and Lakeville, CT based Crescendo, Inc. Her past board service has included Signal Analytics (investment research), Women in New Media, and Canadian Society of New York. She qualifies as a “financial expert” as defined by federal securities laws. Ms. Schalkwyk’s extensive experience and skillset provides valuable insight in today’s complex and fast paced banking environment.

| 8 |

Continuing Directors with Terms Ending in 2024

Arthur J. Bassin has been a director of the Bank and Salisbury since June, 2010. Mr. Bassin served as an Artillery Officer in the U.S. Army from 1965 to 1967. He spent 25 years in consumer, commercial and mortgage banking at Citibank (1969-1983) and Dime Savings Bank of New York (1983-1992), followed by 10 years in private equity, most recently as President and Chief Executive Officer of TVData Technologies (1994-2001). Mr. Bassin earned his MBA from Harvard Business School in 1969 and his AB from Harvard College in 1965. He took office as Ancram Town Supervisor in January 2010. Mr. Bassin has served as a director on several boards and currently serves on the Boards of Cricket Hill Farm, Inc. and Cricket Hill Academy, Inc. He previously served on the Board of Amputee Coalition of America. Mr. Bassin also serves on the Ancram Town Board and the Columbia County Board of Supervisors. Mr. Bassin’s experience in board and community service, consumer, commercial and mortgage banking as well as in private equity, in addition to his demonstrated leadership skills, provides valuable insight and skills to Salisbury and the Bank.

Paul S. Hoffner has been a director of the Bank and Salisbury since May, 2021. Prior to that, he served as a member of the Riverside Division Advisory Board from 2015 to 2020 and Director of Riverside Bank from 2012 to 2014. Mr. Hoffner graduated from Tufts University with a Bachelor of Science in 1986 and earned his MBA from NYU’s Stern School of Business in 1988. He is President of John Herbert Company, a second-generation floor covering contractor based in Newburgh, NY. Mr. Hoffner joined such company in 1988, and 8 years later, he purchased it and began heading its business development effort, a role he is still in today. Mr. Hoffner serves on several philanthropic boards, and his primary interests are providing scholarships for local, less advantaged youth, tackling housing insecurity, poverty alleviation, and financial literacy. Mr. Hoffner has developed an extensive network of relationships in various communities that Salisbury serves which, combined with his education, leadership, and extensive business experience will serve to strengthen our Boards.

Holly J. Nelson has been a director of the Bank since 1995 and of Salisbury since 1998. Ms. Nelson graduated from Cornell University with a B.A. in 1979. She is Development and Events Coordinator for the Hotchkiss Library of Sharon and is a member of Iceland Adventure, LLC, a tour operator. Ms. Nelson has served in a board and leadership capacity for many organizations, including board member of the Berkshire Taconic Community Foundation and board member of the HousingUs affordable housing initiative. She has been involved in a variety of non-profit organizations in NY, CT, and MA, as well as public government positions in the Town of North East, New York. Ms. Nelson’s education, knowledge of marketing and non-profit organizations, and experience in successfully operating small businesses in the New York market area served by the Bank provides valuable perspective and leadership skills to the Board.

CORPORATE GOVERNANCE

Salisbury’s Board of Directors is committed to strong corporate governance practices to maximize Shareholder value while complying with legal requirements and safe and sound banking principles. Accordingly, the Board has adopted corporate governance practices, which, along with the rules and listing standards of the NASDAQ Equities Market (“NASDAQ”) and the regulations of the Securities and Exchange Commission (“SEC”),SEC, are periodically reviewed by Management and the Board.

Meetings and Committees of the Board of Directors

The Board of Directors met thirteen (13)twelve (12) times during 2020.2021. The Board’s committees include the Executive Committee, the Human Resource and Compensation Committee, the Nominating and Governance Committee, and the Audit Committee. The members of the committees are appointed by the Board of Directors at least annually. In addition to these committees, the Bank and Salisbury also maintain committees to oversee other areas of Salisbury’s operations.

During 2020,2021, no director attended fewer than 75% of the aggregate of (1) the total number of meetings held by Salisbury’s Board of Directors during the period that the individual served; and (2) the total number of meetings held by all committees of Salisbury’s Board of Directors on which they served. Salisbury does not maintain a policy for directors’ attendance at Salisbury’s Annual Meetings of Shareholders, but encourages all directors to attend. As a result of the COVID-19 pandemic during 20202021 and the restrictions on public gatherings, noneall of the directors of Salisbury attended Salisbury’s Annual Meeting of Shareholders on May 13, 202019, 2021 via WebEx with the exception of Mr. Cantele.Cantele who attended in person.

Director Independence

AllThe Board has determined that all directors are considered “independent” within the meaning of the independence standards of NASDAQ with the exception of Richard J. Cantele, Jr., who is an executive officer of Salisbury and the Bank. Richard J.Mr. Cantele Jr. does not serve on any of Salisbury’s committees other than the Executive Committee. All members of the Nominating and Governance Committee, Human Resource and Compensation Committee and Audit Committee are “independent”. The Board based these determinations of independence primarily on a review of responses to Director Questionnaires regarding current and previous employment relationships as well as material transactions and relationships between Salisbury and Salisbury’s or the Bank’s directors, members of their immediate families, and entities in which directors have a significant interest.

| 9 |

Board Diversity

As a Smaller Reporting Company, Salisbury meets the diversity objectives of NASDAQ by including at least two female directors.

| Board Diversity Matrix (as of March 16, 2022) | ||||

| Total Number of Directors | 9 | |||

| Female | Male | Non-Binary | Did Not Disclose Gender | |

| Gender Identity | ||||

| Directors | 4 | 5 | 0 | 0 |

| Demographic Background | ||||

| African American or Black | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 4 | 5 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 | |||

| Did Not Disclose Demographic Background | 0 | |||

Executive Committee

The Executive Committee has general supervision over the affairs of Salisbury between meetings of the Board of Directors. The current members of the Executive Committee are Charles M. Andola (who is retiring from the Board on May 19, 2021), Arthur J. Bassin, Richard J. Cantele, Jr., David B. Farrell (Chair), Nancy F. Humphreys, Neila B. Radin, and Grace E. Schalkwyk. The Executive Committee met one (1) timedid not meet during 2020.2021.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for assisting the Board of Directors in identifying and evaluating potential nominees for director and recommending qualified nominees to the Board for consideration; oversight of the annual evaluation process for the Board of Directors; and selecting director nominees to stand for election at Salisbury’s annual meetings of Shareholders. The Nominating and Governance Committee is also responsible for making recommendations to the Board of Directors relating to appropriate corporate governance matters, developments and practices. The Nominating and Governance Committee considers various factors and qualifications, in accordance with its Charter, Salisbury’s Bylaws and Certificate of Incorporation and applicable law. Its process for identifying and evaluating nominees for director has historically operated informally and without any differences in the manner in which it evaluates nominees recommended by Shareholders. The Nominating and Governance Committee is responsible for reviewing Shareholder nominations submitted to Salisbury. The Nominating and Governance Committee determines whether such nomination was submitted timely and whether it satisfies all applicable eligibility requirements before recommending appropriate action to the Board of Directors.

The Nominating and Governance Committee and the Board of Directors consider factors such as established age and tenure guidelines as well as those summarized below in evaluating director candidates, including any nominee submitted by Shareholders, and trust that Salisbury’s Bylaws, Nominating and Governance Committee Charter and the qualifications and considerations such as those enumerated below provide adequate guidance and flexibility in evaluating candidates. The Board of Directors has adopted a policy with regard to the consideration of diversity in identifying director nominees, and remains committed to diversity at the Board level as well as with regard to employees. An audit or monitoring of such policy is performed periodically to examine and evaluate the effectiveness of the policy, as well as compliance with relevant laws, regulations and/or best practices. Audits of the policy are performed by either internal audit or Salisbury’s Risk Management Department and are submitted to the Audit Committee for review. Salisbury’s Nominating and Governance Committee works to ensure that the Board is composed of individuals with expertise in fields relevant to Salisbury’s business, experience from different professions and industries, a diversity of age, ethnicity and gender and a range of tenures. This approach has proven beneficial given the complex and dynamic nature of the banking industry. The Nominating and Governance Committee considers a number of qualifications when identifying and recommending a director nominee, including whether the nominee would assist in achieving a mix of board members that represents a variety of background, experience and diversity. Salisbury has been a leader in Board diversity, particularly with respect to gender diversity, with four women serving on the Board, and diversity of professional experience.

| 10 |

Qualifications for director candidates include:

| · | Sound business judgment and financial sophistication in order to understand Salisbury’s financial and operating performance and to provide strategic guidance to management. |

| · | Business management experience. |

| · | Integrity, commitment, honesty and objectivity. |

| · | A general familiarity with (i) prudent banking principles; (ii) bank operations/technology; (iii) pertinent laws, policies and regulations; (iv) markets and trends affecting the financial services industry; and (v) local economic and business opportunities. |

| · | Strong communication skills in order to function effectively with Salisbury’s constituencies. |

| · | A financial interest in Salisbury as a Shareholder. Generally, candidates should not have relationships with Salisbury or the Bank that would disqualify the candidate from being considered independent. |

| · | Generally, candidates should be involved in philanthropic, education, business or civic leadership positions. |

| · | Generally, candidates should assist in achieving a mix of board members that represents a variety of background, experience and diversity. |

| · | Generally, candidates should be familiar with the geographic areas served by Salisbury. |

| · | Candidates should evidence a willingness and commitment to devote sufficient time and energy to prepare for and attend Board of Director and committee meetings and to diligently perform the duties and responsibilities of service as a director. |

| · | Candidates should not have interests that conflict with those of Salisbury or the Bank. |

Salisbury has not paid a fee to any third-party or parties to identify or assist in identifying or evaluating potential nominees. The Board of Directors and Nominating and Governance Committee do not discriminate on the basis of sex, race, color, gender, national origin, religion or disability in the evaluation of candidates. The Nominating and Governance Committee also recommends to the Board of Directors for its approval that directors serve as members of each committee, recommends corporate governance principles applicable to Salisbury, and oversees the annual evaluation process for the Board.

A copy of Salisbury’s Nominating and Governance Committee Charter is available on Salisbury’s website at salisburybank.com under “Shareholder Relations”, “Governance Documents”.

Any Shareholder who wishes to recommend a nominee for director should send the required information, as set forth below and in Salisbury’s Bylaws, to the attention of the Secretary at Salisbury Bancorp, Inc., 5 Bissell Street, P.O. Box 1868, Lakeville, Connecticut 06039-1868. Such nominations by a Shareholder shall be made only if such written notice of such Shareholder’s intent to make such nomination has been given to the Secretary not less than twenty (20) days and not more than sixty (60) days prior to the anniversary of the date on which Salisbury first mailed its proxy statement related to the annual meeting in the prior year.

Such Shareholder’s notice shall set forth (1) as to each person whom the Shareholder proposes to nominate for election as a Director, (a) the name, age, business address and residence address of such person, (b) the principal occupation or employment of such person, (c) the class and number of shares of Salisbury that are beneficially owned by such person, and (d) any other information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to applicable law and regulations (including without limitation such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); and (2) as to the Shareholder giving the notice, (a) the name and address, as they appear on Salisbury’s books, of such Shareholder, (b) the class and number of shares of Salisbury that are beneficially owned by such Shareholder, (c) representation that the Shareholder is a holder of record of Common Stock of Salisbury entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, and (d) a description of all arrangements or understandings between the Shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the Shareholder.

The current members of the Nominating and Governance Committee are George E. Banta, Arthur J. Bassin, David B. Farrell, Holly J. Nelson, (Chair), and Neila B. Radin.Radin (Chair). All such members are “independent” in accordance with the independence standards of NASDAQ. The Nominating and Governance Committee met two (2)four (4) times during 2020.2021. All nominees for directors at the 20212022 Annual Meeting were nominated by the Nominating and Governance Committee and the Board of Directors.

Audit Committee

Salisbury’s Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Exchange Act for the purpose of overseeing the accounting and financial reporting process of Salisbury and audits of the financial statements of Salisbury. Subject to the Audit Committee Charter, the Audit Committee provides assistance to the Board of Directors in fulfilling its responsibility to the Shareholders, potential Shareholders and investment community relating to corporate accounting, reporting practices of Salisbury, and the quality and integrity of the financial reports of Salisbury. In so doing, it is the responsibility of the Audit Committee to appoint and oversee the independent auditors for Salisbury and to maintain free and open means of communication between the directors, the independent auditors, the internal auditors and the financial management of Salisbury.

| 11 |

The responsibilities of the Audit Committee are governed by Salisbury’s Audit Committee Charter, which was adopted by Salisbury’s Board of Directors. Its current members are David B. Farrell, (Chair),Paul S. Hoffner, Nancy F. Humphreys John F. Perotti (who is retiring from the Board on May 19, 2021)18, 2022), Neila B. Radin, and Grace E. Schalkwyk.Schalkwyk (Chair). The Audit Committee formally met eight (8) times during 2020.2021. Each of the members of the Audit Committee is an “independent director” in accordance with the independence standards of NASDAQ. The Board of Directors has determined that David B. Farrell and Grace E. Schalkwyk each qualify as an “audit committee financial expert” as such term is defined by federal securities laws and regulations. Additionally, the Board of Directors are of the opinion that the members of the Audit Committee bring diverse educational, business and professional experience that is beneficial to the Audit Committee function of Salisbury and the Bank and enables the Audit Committee to fulfill its responsibility.

A copy of Salisbury’s Audit Committee Charter is available on Salisbury’s website at salisburybank.com under “Shareholder Relations”, “Governance Documents”.

Compensation Committee

The Human Resource and Compensation Committee (the “Compensation Committee”) is currently comprised of the following members of the Board of Directors, all of whom are considered “independent” pursuant to the independence standards of NASDAQ: George E. Banta, Arthur J. Bassin (Chair), David B. Farrell, Nancy F. Humphreys,Paul S. Hoffner, and Neila B. Radin. The Compensation Committee met eight (8) times during 2020.2021.

A copy of Salisbury’s Human Resource and Compensation Committee Charter, which the Compensation Committee and the Board of Directors review and assess at least annually, is available on Salisbury’s website at salisburybank.com under “Shareholder Relations”, “Governance Documents”.

The role and responsibilities of the Compensation Committee as well as discussion of the Compensation Committee processes and procedures, including its use of independent compensation consultants and the role of executive officers in determining or recommending the amount or form of executive and director compensation, are further described below under “Compensation Discussion and Analysis.”

Compensation Committee Report

February 24, 2021.23, 2022. The Compensation Committee performs various functions related to compensation, which is described more fully below. The Compensation Committee has reviewed and discussed with management the section below entitled “Compensation Discussion and Analysis.” Based on this discussion, the Compensation Committee recommended that the Board of Directors include the Compensation Discussion and Analysis in Salisbury’s Proxy Statement relating to its 20212022 Annual Meeting.

Submitted by: George E. Banta, Arthur J. Bassin (Chair), David B. Farrell, Nancy F. Humphreys,Paul S. Hoffner, and Neila B. RadinRadin.

Compensation Committee Interlocks and Insider Participation

No current or former executive officer or other employee of Salisbury or the Bank served on the Compensation Committee in 2020.2021. No executive officer of Salisbury served on the Compensation Committee or the board of directors of any other entity during 20202021 that had one of its executive officers serving on the Compensation Committee or the Board of Salisbury or the Bank. No member of the Compensation Committee of Salisbury had any relationship with Salisbury or the Bank since January 1, 20202021 requiring disclosure under Item 404 of Regulation S-K under the Exchange Act.

Human Capital

Diversity, Equity and Inclusion (“DEI”)

Salisbury understands that our human capital is the most valuable asset we have, and we are committed to fostering, cultivating and preserving a culture of diversity, equity and inclusion. During 2021, the Bank developed a DEI Plan and Policy to cultivate and implement strategies to nurture a culture where talented and committed individuals can thrive. We established a DEI Council comprised of a cross section of employees and senior level management whose responsibilities include, but are not limited to, creating opportunities for employees to meaningfully engage with leadership; providing feedback and insight to executive management in support of current and future workforce needs; review of policies, procedures and processes that may impact DEI efforts; engagement with the communities we serve to promote a greater understanding and respect for diversity; and maintaining a work environment which embraces a variety of employee characteristics. All employees and directors are required to complete annual diversity awareness training. The Board of Directors is committed to diversity at the Board level and currently meets the diversity standards of NASDAQ.

Talent

Salisbury has been successful in attracting, developing and retaining qualified and competent staff. Our longest tenured employee retired in 2021 after 43 years with the Bank and our CEO has been with the Bank in a variety of capacities for 41 years. There are many factors that contribute to this success, including internships, tuition reimbursement, career pathing and customized development plans, a variety of training and professional development opportunities, internal job postings, transfer and promotion opportunities, and a comprehensive Leadership Development Program instituted in 2019. Our workforce turnover rates have historically been lower than our compensation peer group average.

| 12 |

Employee Compensation and Benefits

The bank maintains a comprehensive employee benefit program providing, among other benefits, group medical, dental, and vision insurance, life insurance, disability insurance, a 401k plan, an employee stock ownership plan (“ESOP”), short and long-term incentive programs, paid time off including vacation days, personal days, and paid holidays, and employee recognition programs. The Compensation Committee reviews employee compensation and benefits against our compensation peer group annually.

Workplace Health and Safety

The COVID-19 pandemic presented ongoing challenges during 2021. The safety of our employees, customers and communities continues to be our top priority. Utilizing our Pandemic Planning Policy and Program, we have implemented proper protocols for safety and business continuity. During the pandemic, we maintained safe operations and approximately 50% of our staff are able to work remotely without disruption to our business. We continued to serve customers through our branch lobbies, drive-ups, ATMs, bank-by-appointment, and through the use of our mobile app and online banking services. Since the start of the pandemic, no employees have been furloughed or laid off, and no employee compensation was reduced. We have a Safety Committee comprised of employee representatives and senior managers who conduct routine safety inspections, provide safety training, and promote safe operations. We are proud of our historically low incident rate.

Culture Initiatives and Community Involvement

Our culture is extremely important to us and we seek to attract qualified individuals whose core values are aligned with that of the organization. During 2021, we conducted an employee engagement survey with an astounding 93% participation rate and an overall engagement index of 80%. Our staff value the people they work with, the flexible work arrangements, advancement opportunities and benefits. It also identified an opportunity to strengthen multi-directional communication and continue to demonstrate value, recognition and accountability. Salisbury has a longstanding commitment to supporting the communities we serve, and our staff remains actively engaged in volunteer activities through bank-sponsored events as well as a variety of community non-profits focused on education, economic development, the arts, and health and human services. They volunteered more than 4,600 hours at close to 100 local organizations. Additionally, the bank provided monetary support to more than 140 non-profits during 2021 and collected nearly 2,900 non-perishable food and household items that were donated directly to local community food pantries. Furthermore, the Bank has assisted hundreds of small businesses and their employees through the Paycheck Protection Program (“PPP”). In 2021, the Bank processed nearly $50 million of additional loan applications under the PPP bringing the total loan volume since the inception of this program to almost $150 million.

Succession Planning

The Bank has a robust succession planning process which includes detailed CEO, Board Chair, and Key Employee succession plans. The plans are updated regularly and are reviewed by senior management and the Board of Directors annually.

Pay Equity

Fair and equitable salary administration is predicated on having accurate salary ranges that reflect the relevant labor market. A comprehensive market analysis is conducted and reviewed annually to ensure that our pay is in line with that of our compensation peer group. In an effort to be transparent and educate our employees, they each receive a detailed report of their compensation and benefits annually which outlines their total compensation. The bank complies with Connecticut’s requirements for employers to disclose the wage range for vacant positions to both job applicants and existing employees.

Board Leadership Structure

The Board of Directors regularly reviews and assesses the effectiveness of its leadership structure and will implement any changes as it deems appropriate.

The leadership structure is comprised of a staggered board of directors, which includes the two separate individuals who serve as the Chairman, who is independent under the independence standards of NASDAQ, and the Chief Executive Officer, who also serves as President (and is, therefore, not considered independent as he is an officer of Salisbury). All other directors are independent under the independence standards of NASDAQ. David B. Farrell was elected Chairman of the Board of Salisbury and the Bank May 15, 2019.

Salisbury’s Bylaws provide that the Board shall elect from among its members a Chair of the Board, who shall preside at all Board meetings. If the Chair is an officer of Salisbury or the Bank, the Board shall elect an independent Presiding Director and shall by resolution set forth the duties and responsibilities of the Presiding Director. The Board will elect a Chair, and, if warranted, a Presiding Director, at Salisbury’s Organizational Meeting following the Annual Meeting of Shareholders.

| 13 |

The Board has set the number of directors following the Annual Meeting at nine (9)eight (8). Salisbury has established responsibilities for the Chair and, if warranted, a Presiding Director, to ensure that the Board of Directors is adequately informed about the affairs of Salisbury and the Bank. Salisbury deems that this leadership structure ensures appropriate and effective governance of Salisbury and the Bank.

Consistent with applicable corporate governance guidelines and Salisbury’s Bylaws, the primary responsibilities of the Chair are to be responsible for the leadership of the board meetings, prepare the agenda and preside over meetings.

To assess effective independent oversight, the Board of Directors has adopted several governance practices, including regular executive sessions of independent directors and annual performance evaluations of the directors and the Chief Executive Officer by the independent directors. During 2021, the Board of Directors adopted a Board Chair Succession Plan which provides an appropriate framework to ensure that Salisbury is able to meet the changing needs of the organization; to think about recruitment and assessment of board members before they are needed; and to maintain/improve competencies of board members.

Salisbury recognizes that no single leadership model is appropriate for all companies at all times. The Board of Directors recognizes that, depending upon the circumstances, other leadership models might be appropriate at some point, and the Board of Directors periodically reviews its leadership structure in this regard.

Riverside Division Advisory Board

Following the merger with Riverside Bank in 2014, Salisbury established the Riverside Division Advisory Board whose members are familiar with the products and services that we offer. Such Advisory Board does not directly participate in the governance of Salisbury, but contributes to Salisbury’s success by providing insights and introductions to enable Salisbury to better serve new customers’ needs in Salisbury’s expanded service area. The members of the Riverside Division Advisory Board currently include Ira Effron, Austin “Brud” Hodgkins, Paul S. Hoffner, Stephen P. Lumb (Chair), John P. O’Shea, David E. Petrovits, Steven R. Turk, and Carl S. Wolfson. The Riverside Division Advisory Board met two (2) times during 2020.

Board Role in Risk Oversight

The Board oversees risks inherent to the business of banking by delegating oversight to certain Board committees, management committees and the Chief Executive Officer. Additionally, the Audit Committee monitors: (1) the effectiveness of Salisbury’s internal controls; (2) the integrity of its Consolidated Financial Statements; and (3) compliance with legal and regulatory requirements. In addition, the Audit Committee coordinates with the internal audit function and the independent registered public accountant.

At the monthly Board meetings, the Board receives the minutes from each Committee meeting and the Chair of each Committee reports on Committee actions. The Board also receives various reports from key members of senior management and regularly reviews and discusses these reports with senior managers. The Board reviews the policies and practices of Salisbury and the Bank on a regular basis. In addition, the Board reviews corporate strategies and objectives and evaluates business performance.

During times when there may be elevated levels of risk, such as those presented by the COVID-19 pandemic, the Board monitors the impact on the risk profile by regularly reviewing and monitoring management’s response and actions taken to mitigate risks, including financial and non-financial risks, business continuity, and human capital risks.

Code of Ethics

Salisbury has adopted a Code of Ethics and Conflicts of Interest Policy that applies to Salisbury’s directors, officers and employees, including Salisbury’s Principal Executive Officer and Principal Financial Officer. A copy of such Code of Ethics is available upon request, without charge, by writing to Shelly L. Humeston, Secretary, Salisbury Bancorp, Inc., 5 Bissell Street, P. O. Box 1868, Lakeville, Connecticut 06039-1868.

Derivative Trading and Hedging

Salisbury has a policy that all of its directors, officers and other employees who possess material nonpublic information regarding Salisbury refrain from making any purchases, sales or recommendations relating to Salisbury. In addition, it is Salisbury’s policy that all directors, officers and employees shall not engage in any of the following activities with respect to Salisbury’s securities: (1) trade in Salisbury’s securities on a short-term basis; any security of Salisbury purchased by a director, officer or employee of Salisbury is to be held for investment rather than trading purposes (which generally means for a minimum of nine (9) months before sale, unless the security is subject to a forced sale which has been approved based upon a significant and unexpected change in the financial circumstances of the purchaser, such as the death or serious illness of a family member, or other substantial justification; (2) purchase Salisbury’s securities on margin; or (3) make any “short-sales” of Salisbury’s securities.

Board of Directors’ Communications with Shareholders

Salisbury’s Board of Directors does not have a formal process for Shareholders to send communications to the Board of Directors. However,Directors, however, the volume of such communications has historically been de minimus. Accordingly, the Board of Directors considers Salisbury’s informal process to be adequate to address Salisbury’s needs.the needs of Salisbury and its shareholders in this regard. Historically, such informal process has functioned as follows: any Shareholder communication is forwarded to the President and Chief Executive Officer for appropriate discussion by the Board of Directors and the formulation of an appropriate response. Shareholders may forward written communications to the Board of Directors by addressing such comments to the Board of Directors of Salisbury Bancorp, Inc., 5 Bissell Street, P. O. Box 1868, Lakeville, Connecticut 06039-1868.

| 14 |

Audit Committee Report

March 4, 2021.2022. The following is the report of the Audit Committee with respect to the audited financial statements for the fiscal year 2020.2021. The Audit Committee has reviewed and discussed Salisbury’s audited financial statements for the fiscal year ended December 31, 20202021 with management and has discussed the matters that are required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board, with Baker Newman & Noyes, P.A., LLC (“BNN”), Salisbury’s independent registered accounting firm.

The Audit Committee has received the written disclosures and the letter from BNN required by the Public Company Accounting Oversight Board for independent auditor communications with Audit Committees concerning independence, and has discussed BNN’s independence with respect to Salisbury with BNN.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Salisbury’s Annual Report on Form 10-K for the fiscal year ended December 31, 20202021 for filing with the SEC.